Our Services

Board Appointment

Our philosophy is to generate interviews through “attraction” instead of “promotion,” meaning that rather than hunt for open board seats and promote you to the decision maker, we educate decision makers about you in a critical mass of well researched companies with boards and committees where your background would be applicable, then let the decision maker invite you to the discussion, akin to the concept of permission-based marketing.

Review Our Board Director Client Experiences

Overview

What is a Board of Directors?

A board of directors is a group of people legally appointed to govern an organization. Most board directors are not directly involved with the day-to-day operations of the company, instead are tasked with bigger decisions concerning the future and scope of the organization. In a for-profit organization, board directors are responsible for representing the interests of the stockholders. In a non-for-profit organization, the board members serve stakeholders, who may include the local community or those served by the organization.

Every publicly traded company in the U.S. must have a board of directors, there are approximately 5000 public companies in the US and at least 20,000 private equity portfolio companies, hedge funds, mutual funds and real estate investment trusts companies, who have paid boards as well. The average board tenure lasts about eight years and there are approximately 10,000 board seats needing to be filled every year.

History of the Corporate Board

The earliest form of a board of directors dates back to the Company of Merchants of the Staple, in the early 1300s and the Company of Merchant Adventurers, in the 1500s, both of which were royal charters. In the 16th and 17th centuries, the East India Company, the Hudson’s Bay Company and the Levant Company, among other major organizations, introduced the concept of a joint-stock company. Even then, there was some balance of power and decision-making between larger groups of individuals. The East India Company was organized into a “court” of directors who operated by committee and were elected by proprietors, or shareholders.

By the 1930s, the Securities and Exchange Commission (SEC) was established in the United States to regulate securities markets, in response to the stock market crash of 1929 and the Great Depression. In the 1970s, the term “corporate governance” was first used in the United States Federal Register. At the same time, the bankruptcy of the Penn Central Railway company, public scrutiny of its board and clear misconduct from its executives led the SEC to require companies listed in the New York Stock Exchange to have an audit committee composed of all independent board directors. Other forms of committees soon followed suit. The “Deal Decade” of the 1980s saw the formation of the Institutional Shareholder Services (ISS) to assist with voting rights and now continues to advise institutional investors on corporate governance issues.

The major 2008 collapse of the Lehman Brothers Bank grew into the worst financial crisis in the United States since the Great Depression. In 2010, the Dodd-Frank Wall Street Reform and Consumer Act was passed by Congress to stabilize the economy, restraining large financial firms from continuing to grow, restricting risky financial activities and providing the government with a way to properly halt failing financial organizations. In more recent years, there has been a heavy emphasis on best practices for corporate governance, including transparency and accountability. Corporations today are encouraged to adhere to ESG principles, commit to fostering diversity and stay on pace with emerging technologies. The future of corporate governance remains to be seen, but it is clearly ever-evolving.

The Role

Board Duties & Responsibilities

The board is responsible for planning the long-term future of a corporation. Board directors make decisions in the best interests of the stakeholders, including employees, customers and the community, report the performance of the organization, including fiscal accountability, budgeting and policy and manage resources to keep the operation running efficiently and effectively. The board works alongside management to align the company’s vision with more immediately attainable short-term goals, maintaining continuity and representing the organization’s core values. Boards often work closely with the CEO and review the performance of the CEO in terms of succession planning. Board-management relationships are essenital to the function of the company.

On a more day-to-day level, a board director is expected to complete all due diligence and preparation prior to board meetings and attend and actively participate in all board meetings. The basic formula requires three hours of preparation for every one hour of actual board meeting time. Preparation may include reviewing financial documents and annual reports and performing industry and competitor research. Such preparation is not to be taken lightly.

Company Vision

Provide continuity and a vision that correctly represents the organization’s core values.

Decision-making

Make decisions in the best interests of the stakeholders, including employees, customers, and the community.

Succession Planning

Review the performance of the CEO – should the CEO not be performing at the level he/she is expected to, the board is also responsible for selecting and appointing a new CEO.

Public Reports

Report the performance of the organization, including fiscal accountability, budgeting, and any enacted policies.

Manage Resources

There must be sufficient resources to keep the operation running efficiently and effectively.

What Can You Gain?

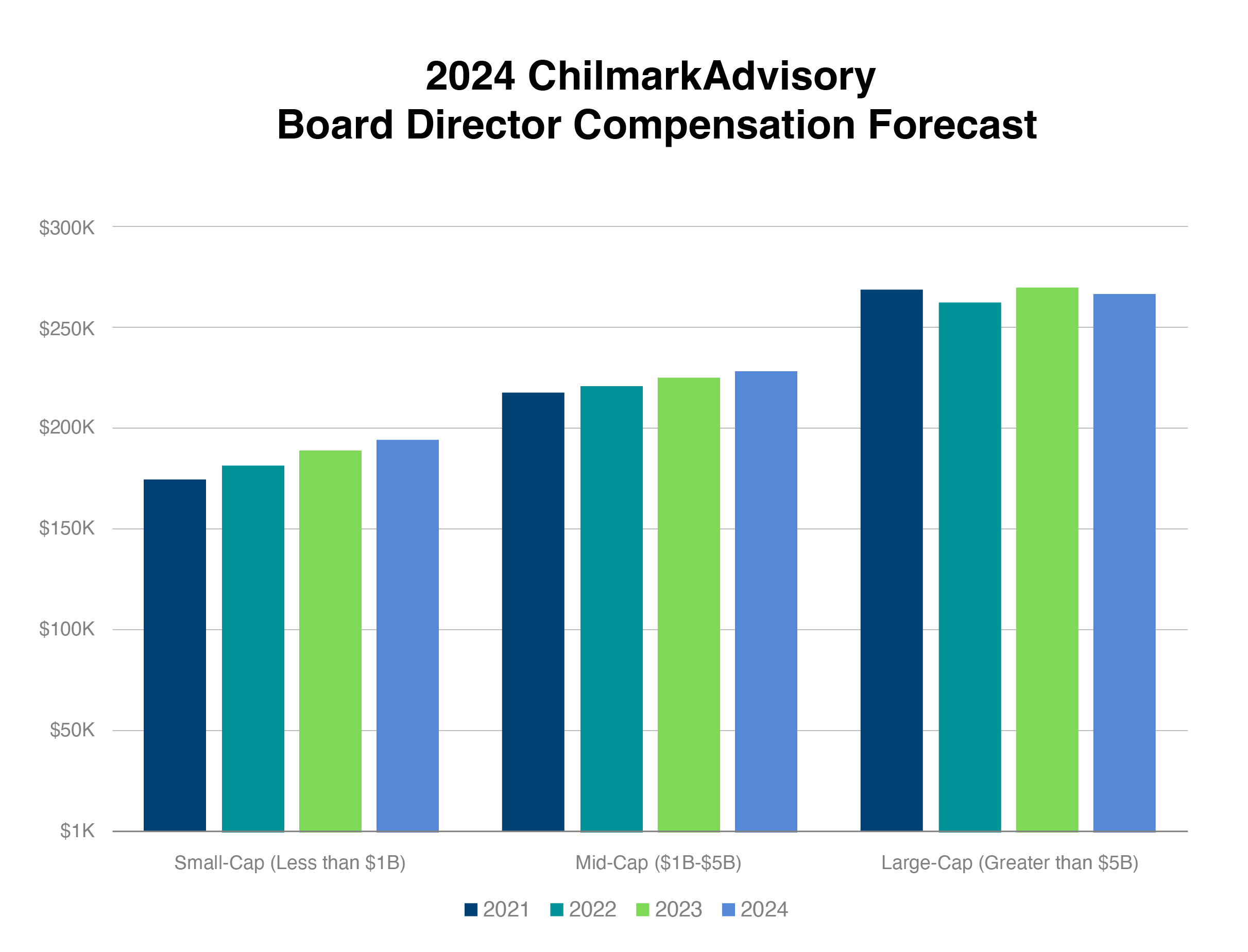

Director compensation is usually a combination of cash and stock. Cash payments include an annual retainer, a set payment per meeting and reimbursement for any expenses incurred. The average annual retainer for board directors is $96,649, although Fortune 100 company retainer payments are often considerably greater than average. Small companies have also been known to award very generous retainer packages. The average board meeting payment is $2,224, with additional stock options or equity grants. Payments in stock are usually consituted of an initial grant and then additional stock for each year served on the board. It is common for directors to gain stock option grants from the sale or merger of the company. Committee chair positions earn further compensation.

In addition to the monetary incentives, board directors also benefit from professional gain. Boards are generally comprised of individuals from very diverse and accomplished backgrounds. From gaining exposure to executives in other industries, or even within the same industry, board directors gain exposure to others’ unique expertise and perspectives from a wide array of fields. Additionally, a company with a strong management team means its board will benefit from a robust professional reputation in the business world. It is a compliment for a company to pay for your input and service. Ultimately, serving on a board will provide you with attractive career growth, expand your professional network and offer you the opportunity to serve on and learn from a diverse team of knowledge experts.

So do I Qualify to be on a Board of Directors?

A qualified board director fosters collaborative relationships with the CEO and fellow board directors, articulates knowledgeable opinions to the rest of the group and generates consensus within the board. It is essential for a board director to possess a fundamental understanding of financial statements, including balance sheets, profit and loss statements, cash flow analysis and audit reports. Additionally, current and future board directors benefit from access to personal resources like government leaders, professional relationships, past or present industry colleagues, attorneys, accountants and consultants.

Qualifications and Selection

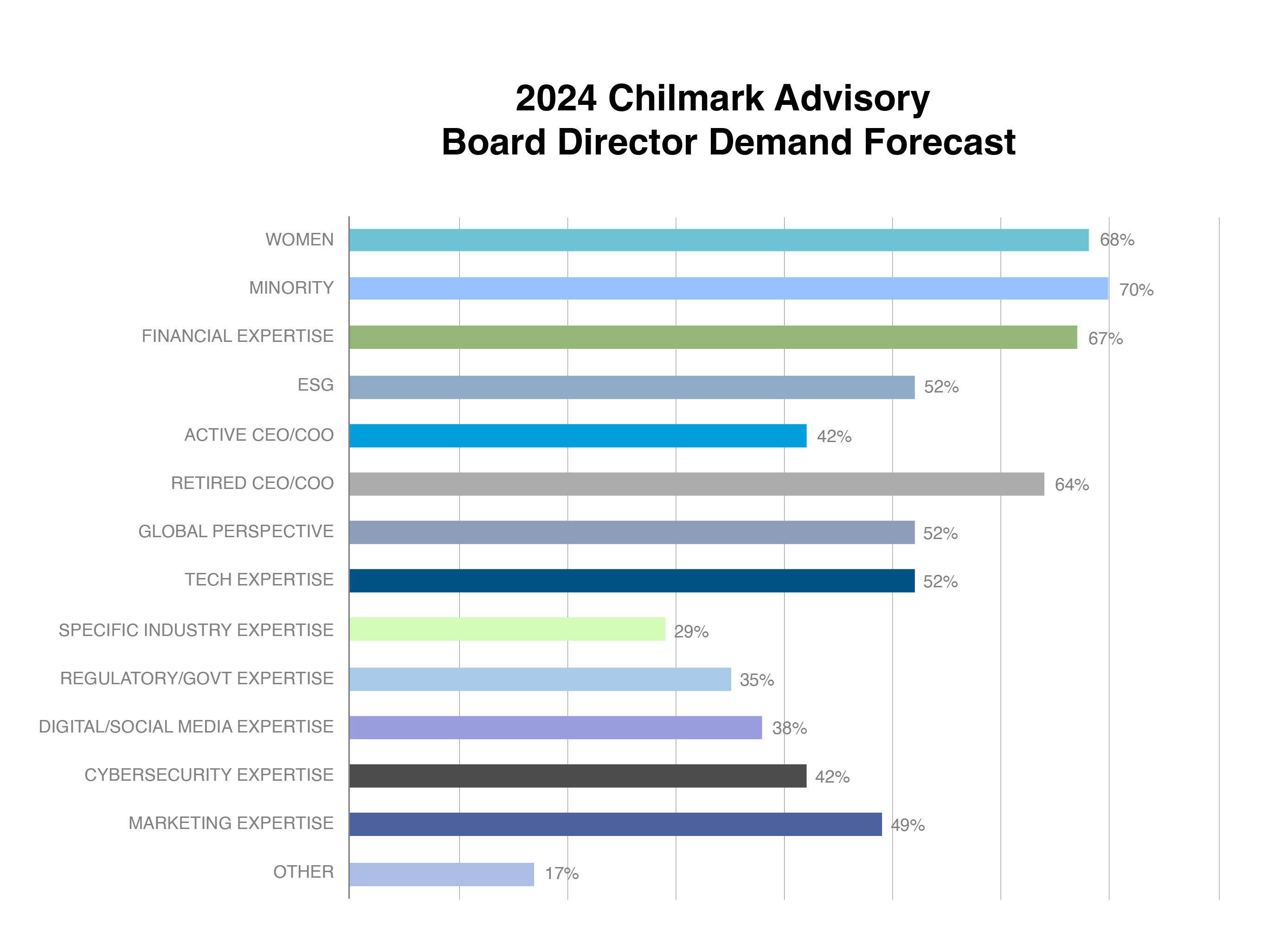

A board may begin the search for a new member when a director leaves due to mandatory retirement, death, conflicts of interest, disability or resignation. Different backgrounds are desired of potential board members, depending on the state of the company. If a company is preparing to go public, a director with previous IPO experience would provide valuable insights. A director with a successful history driving turnaround situations makes an attractive asset to a company in a distress. For a company expanding offshore, a director with international experience may be highly desirable. In particular, the demand for directors with experience in digital sectors like cybersecurity and social media management is increasing with the age of technological innovation and digital transformation.

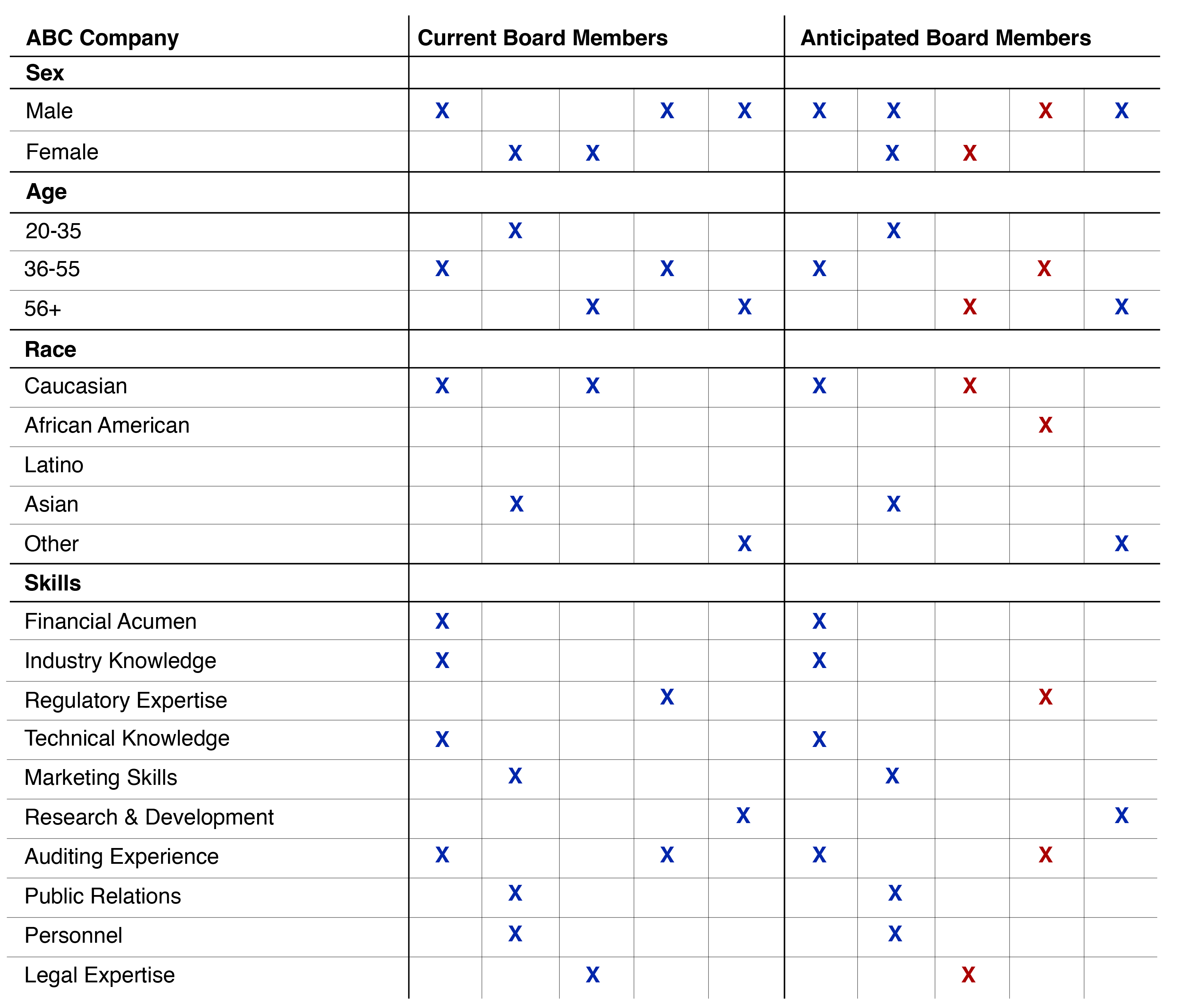

Grid Seat Selection

Companies often use a method called grid seat selection to strategically fill board appointments. This approach helps ensure a balanced and effective board composition by evaluating skills, experience and diversity of existing board members, identifying gaps or areas that need strengthening and determining qualifications needed in new board directors. Targeted recruitment relies on the grid to guide the search for potential candidates. The grid matrix is formatted by outlining the board’s most desirable attributes along one axis and the names of each current director along the other axis. Backgrounds that the board already possesses are checked off, while the remaining banks become deficits that the board seeks to fill. In this way, future board directors are evaluated on their individual merits, but also on how they complement the existing board.